Looking for a new house, whether to purchase or just to rent, can be a…

Renting vs. Buying a House

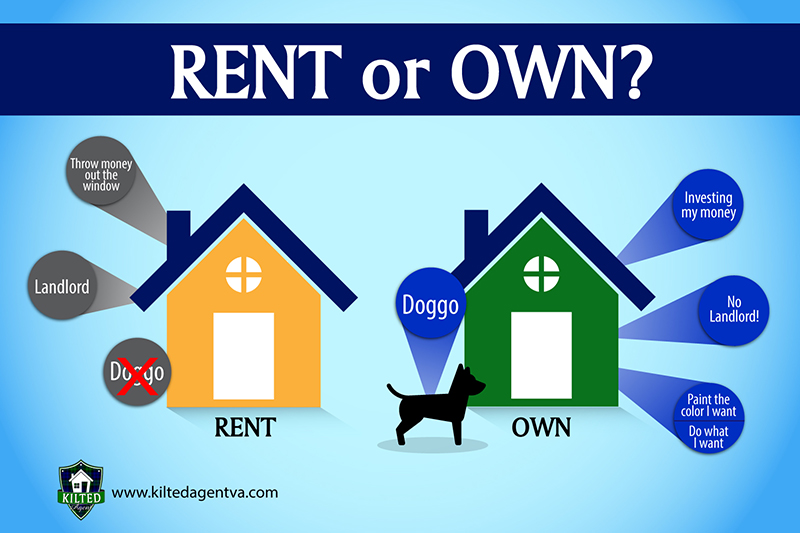

Choosing whether to rent or purchase a house is a significant choice that impacts both your lifestyle and your financial well being. Real estate ownership is promoted as a long-term investment that will likely grow equity and provide tax benefits. Renting offers its own set of benefits, including a lack of responsibility and freedom. People frequently assume, however, that purchasing a property rather than renting is the more financially sensible option.

Many individuals like to be owners. This is partially due to the widespread belief that owning a home is the key to happiness and a component of everyone’s goal. From mortgage lenders to real estate brokers to home renovation businesses, real estate is a major business. It’s ingrained in our culture and economics. It’s crucial to note, though, that owning a house isn’t always preferable to renting, and that renting isn’t always as straightforward as it appears. Consider the advantages and disadvantages of each to determine if renting or buying is the best option for you.

TAKEAWAYS Essential

-Renting provides flexibility, predictability in monthly costs, and the ability to delegate maintenance to someone else.

-Homeownership has intangible advantages. They include the intangibles of tax deductions and equity, as well as a sense of security, belonging to a community, and pride of ownership. – Contrary to common assumption, renting does not imply “throwing money away” every month, and buying does not automatically result in “long-term riches.”

Renting :-

When you rent, you have the freedom to move whenever your contract expires. However, if your landlord decides to sell the property or convert your apartment complex into condominiums, you may be forced to relocate quickly. They might just raise the rent to an amount that you cannot pay.

The most common misconception about renting is that you’re “squandering money” every month. This isn’t correct. You’ll need a place to reside, which will cost you money in some way. While it is true that monthly rent payments do not contribute to equity growth, not all of the costs of owning contribute to equity growth.

What to rent? :-

When you rent, you know precisely how much you’ll pay each month for accommodation. When you own a home, you may just have to pay your mortgage and monthly bills in a single month. Then, the following month, you may have to pay extra for a new roof (which your homeowners’ insurance may not cover).

While a leaky roof may cause temporary discomfort as a renter, it’s unlikely that you’ll ever have to pay to repair your roof while renting. Home-related monthly expenditures, such as renter’s insurance, are usually more predictable and substantially less expensive.

Each time your lease is up for renewal, you risk an uncertain rent rise as a tenant (unless your apartment is rent-controlled). Rent hikes might be significant if you reside in the desired neighborhood. Your monthly housing payments will never increase if you acquire a fixed-rate mortgage, on the other hand (though property taxes and insurance premiums probably will).

While homeownership is frequently promoted as a means of accumulating wealth, your home’s worth might depreciate. It’s possible that the pleasant area where you recently relocated may deteriorate. A large company might depart the region, resulting in a significant population drop and a housing surplus. Alternatively, there may be a surge in home building, which would keep prices low. Tomorrow, you may buy a home for BD75,390 & you’ll subsequently find that it’s still worthless after 30 years, implying that you’ve lost money due to inflation.

Another piece of erroneous conventional wisdom: Get a mortgage to take advantage of the tax deduction. True, as long as you itemize, the home mortgage interest deduction decreases your out-of-pocket mortgage interest payments early in your loan term. There is no tax benefit to you as a homeowner if you don’t have enough deductions to itemize and use the basic deduction. If you itemize, you’ll save cents on the dollar for every $1 you spend on interest—an amount that will only drop over time as you pay down your mortgage.

Renters, of course, are not eligible for a mortgage tax deduction. However, they are eligible for the standard deduction, which is accessible to all taxpayers.

Do you enjoy having your evenings and weekends free to do anything you want? Do you work a lot of hours or travel a lot? If that’s the case, the time commitment that comes with homeownership could be too much for you. From locating a plumber to fixing a rusted-out pipe to repainting the bedroom to mowing the grass, there are always chores around the house that you may need or want to take care of.

If you reside in a community with a homeowners association (HOA), the HOA may be able to relieve you of some of your homeownership responsibilities. Typically, this will set you back a few hundred dollars every month. But be wary of the difficulties that come with becoming a member of an association.

If you rent an apartment, your landlord is responsible for all repairs and upkeep, however they may not be completed as quickly or as well as you would want.

Renters’ insurance is commonly advised for individuals leasing houses and is increasingly mandated by landlords, however it is not as widespread as homeowners’ insurance.

Owning :-

Intangible benefits such as a sense of stability, belonging to a community, and pride of ownership come with homeownership. It is not, however, suitable for restless or migratory individuals. The first illiquid asset was real estate. If the property market is down, you might not be able to sell when you desire. Even if it’s up, selling incurs substantial transaction fees. When you buy a home, it is much more expensive to change your mind about where you want to live. The total cost of owning is often higher than the total cost of renting. Even if the monthly mortgage payment is comparable to (or less than) the monthly rent, this is true.

As a homeowner, you’ll have to pay for various expenditures that you wouldn’t have to pay as a renter :-

-Taxes on real estate

-Garbage collection

-Service for water and sewage

-Maintenance and repairs

-Controlling pests

-Pruning trees

-Insurance for homeowners

-Cleaning the pool (if you have one)

-In certain regions, flood insurance is required by the lender.

-In some locations, earthquake insurance is available.

Mortgage interest is perhaps the most wasteful cost, as it may account for virtually all of your monthly payments in the early years of a long-term loan. Consider the following scenario: You take out a 30-year loan for 37,691.27 Bahraini Dinar at 4% interest. Your first monthly payment will be 179.95 Bahraini Dinar, including interest of 125.64 Bahraini Dinar and principal of 54.31 Bahraini Dinar.

Even renovation efforts seldom enhance the value of your property by more than the amount you spend on them. According to Remodeling magazine, you’ll receive very little back for every dollar you spend on a home renovation job. 2 The initiatives that recuperate the most money aren’t glamorous and won’t make you happy.

When you total up all of these expenditures, you could discover that renting and putting the money you would have spent on a home in a retirement account is a superior financial decision.

Invest in the brands you want to support.

Every day, you interact with world-class brands and are familiar with their products. What if you could use all of that information to your advantage? A well-known investment technique and an excellent approach to get started in stock trading is to “buy in what you know.”

akomakoo.com is the leading property search website for users in the Kingdom of Bahrain and the Eastern Province of Saudi Arabia. Launched in 2020, by Abdul Hamid Al Asfoor (Managing Director of Albayan Media Group), akomakoo.com has become the most exclusive and leading platform connecting buyers and sellers from Saudi Arabia to Bahrain and vice versa.

An exclusive and trusted community where underused goods are redistributed to fill a new need, and become wanted again, where non- product assets such as space, skills and money are exchanged and traded in new ways that don’t always require centralized institutions or ‘middlemen’.

I hold a bachelors degree in business administration and I’m currently working to obtain knowledge & experience on the day to day activities in the business field for a bright future.